What Is NEPSE TMS And How To Open A TMS Account?

At first let’s start with the full form of TMS or Nepse TMS. It’s short form of Nepal Stock Exchage Trading Management System. TMS is the crucial element of the share market in Nepal as you need to have a TMS account to buy and sell shares in secondary market.

We hope that you are aware of Primary market and the secondary market in Nepal stock market. If you don’t know let’s have a quick recap of those two market type.

What Is NEPSE TMS And How To Open A TMS Account?

A primary market is a market that issues new securities on Nepal stock exchange or let’s the it is the process of issuing IPO for the first time where you need to apply for the IPO with the base price, and the Secondary market is the place where you buy and sell the share or the stock. In the primary market, you can only buy the shares in the form of IPO but you can’t sell it. If you want to sell the stock or the shares you need to join the secondary market and the only way to do is to create an account with the stock brokers. There are multiple brokers companies in Nepal from where you can trade your shares. These days, you can easily buy and share by online sitting in your home with the help of TMS account which you can create from the brokers.

Step by step process of creating TMS account or broker account.

At first you need to go to the link of the desired broker where you want to open your broker account. If you don’t know the address you can go to our blog post on the brokers from where you can get the address.

At first you need to have a copy of the citizenship,KYC form, DP ID and your photo before going through the sign up link.

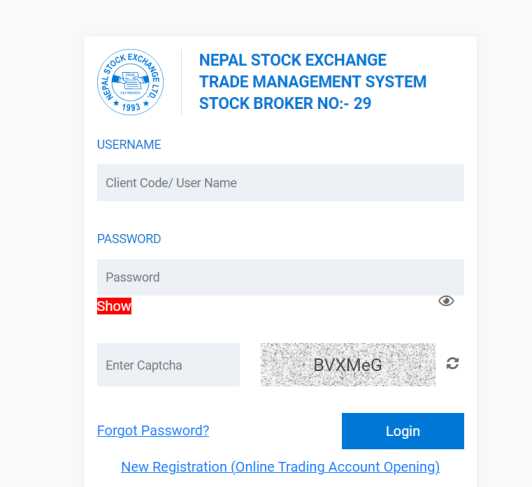

Here, we are going to show you the process on creating account on broker number 29.

Click the link of the broker address.

You need to click on the new registration. After clicking on that you will be greeted with the new screen where you need to fill up the general information like your mobile number, broker branch details, email address and if possible PAN number too.

Click on next button after you are done with the filling up the general information. In the next screen, you need to fill up your individual details like your name, date of birth, gender, father’s name, mother’s name and the grandfather’s name. You need to be careful while filling up your individual details.

In the second screen, You need to fill up your bank details.

In the next screen, you need to fill up the BOID number.

Now, you will the see the screen where you need to upload a copy of your citizenship and the KYC form. These documents must be on pdf format and submit the application.

After few days, you will get the login details. Sometime it might get delayed and for that case you need to contact your broker office.